"davesaddiction @ opposite-lock.com" (davesaddiction)

"davesaddiction @ opposite-lock.com" (davesaddiction)

09/08/2017 at 11:03 ē Filed to: None

0

0

31

31

"davesaddiction @ opposite-lock.com" (davesaddiction)

"davesaddiction @ opposite-lock.com" (davesaddiction)

09/08/2017 at 11:03 ē Filed to: None |  0 0

|  31 31 |

Anyone else doing this in light of the Equifax data breach? For those who have done credit freezes in the past, any advice? I guess I shouldíve gone to AnnualCreditReport.com first to get my reports, but we recently bought a new home and nothing seemed amiss.

random001

> davesaddiction @ opposite-lock.com

random001

> davesaddiction @ opposite-lock.com

09/08/2017 at 11:14 |

|

Iím literally applying to refinance this week, so can I do that?

Straightsix9904

> random001

Straightsix9904

> random001

09/08/2017 at 11:21 |

|

Closing on a house in 3 weeks....Iím in the same boat? I mean, financing is set, but I donít want to screw up anything.

diplodicus

> davesaddiction @ opposite-lock.com

diplodicus

> davesaddiction @ opposite-lock.com

09/08/2017 at 11:22 |

|

This is the first I heard of this. Looked it up the bastards waited 5 weeks to tell anyone. Fucking assholes.

KusabiSensei - Captain of the Toronto Maple Leafs

> diplodicus

KusabiSensei - Captain of the Toronto Maple Leafs

> diplodicus

09/08/2017 at 11:30 |

|

Chances that anyone will get fined or jailed over it? Zero. Because only little people go to jail for doing bad things.

Textured Soy Protein

> davesaddiction @ opposite-lock.com

Textured Soy Protein

> davesaddiction @ opposite-lock.com

09/08/2017 at 11:31 |

|

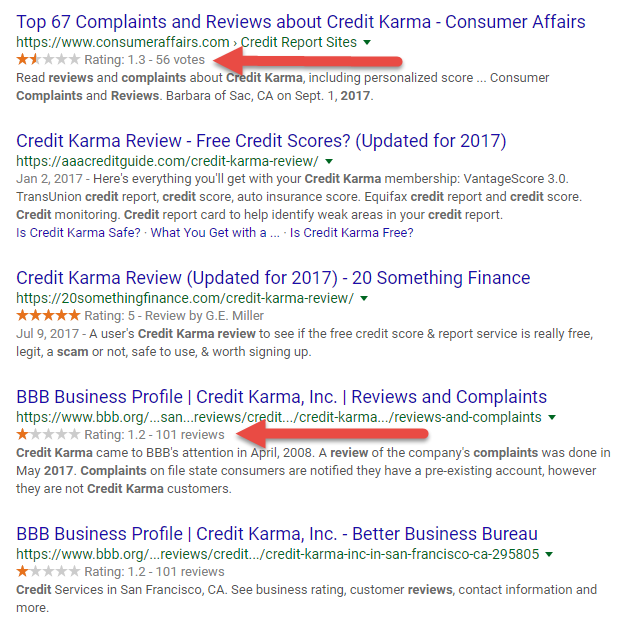

Use Credit Karma for credit monitoring. Itís totally free. They make their money if you sign up for a loan or credit card through them but everything to do with your credit score is free.

diplodicus

> KusabiSensei - Captain of the Toronto Maple Leafs

diplodicus

> KusabiSensei - Captain of the Toronto Maple Leafs

09/08/2017 at 11:32 |

|

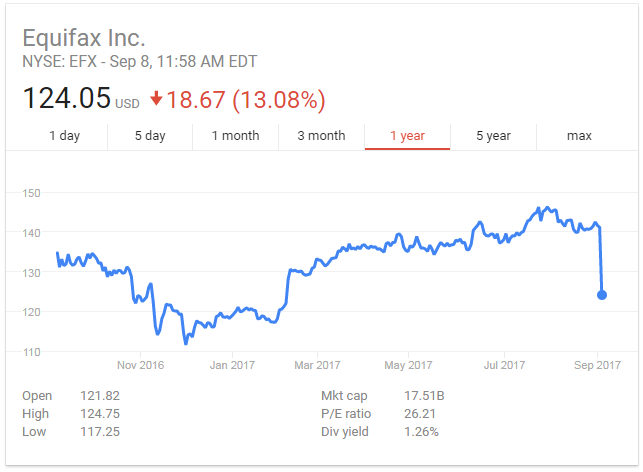

They even allowed the CFO to sell like 1million in shares or something too. Which he claims he was unaware of the breach at the time, total bullshit.

vondon302

> diplodicus

vondon302

> diplodicus

09/08/2017 at 11:32 |

|

And the chairman of the board sold a bunch of stock right after they found out but before they announced it.

Assholes

Aaron M - MasoFiST

> davesaddiction @ opposite-lock.com

Aaron M - MasoFiST

> davesaddiction @ opposite-lock.com

09/08/2017 at 11:37 |

|

Just as a warning, do not use the Equifax site to check if you were affected...thereís an arbitration agreement buried in there so using their site is bundled with waiving your right to sue them.

KusabiSensei - Captain of the Toronto Maple Leafs

> diplodicus

KusabiSensei - Captain of the Toronto Maple Leafs

> diplodicus

09/08/2017 at 11:51 |

|

Well, of course it is, but they donít care because they got theirs already.

CB

> Textured Soy Protein

CB

> Textured Soy Protein

09/08/2017 at 11:52 |

|

Just did that because Iíve never actually checked my credit score before. Turns out Iím doing pretty well. Cheers (well, you and my sister) for vouching for the site!

davesaddiction @ opposite-lock.com

> Aaron M - MasoFiST

davesaddiction @ opposite-lock.com

> Aaron M - MasoFiST

09/08/2017 at 11:54 |

|

I didnít. Just went directly to the freeze.

davesaddiction @ opposite-lock.com

> Textured Soy Protein

davesaddiction @ opposite-lock.com

> Textured Soy Protein

09/08/2017 at 11:55 |

|

ďA credit freeze is different than any sort of fraud alert, which a credit bureau might suggest using after your identity has already been compromised.

When you set up a fraud alert, ďno one is supposed to give credit in your name without checking with you first to make sure that it is you and not an identity thief,Ē Weisman explains.

However, consumers often ignore these alerts ó and even companies will ignore them when checking your credit report and issuing a credit card, for example.

Weisman likens these alerts to getting hit by a truck ó then having a passerby say, ď Hey, you got hit by a truck. Ē

At that point, itís kind of too late.Ē

Read this somewhere else. May still sign up for the service...

davesaddiction @ opposite-lock.com

> Textured Soy Protein

davesaddiction @ opposite-lock.com

> Textured Soy Protein

09/08/2017 at 11:57 |

|

davesaddiction @ opposite-lock.com

> diplodicus

davesaddiction @ opposite-lock.com

> diplodicus

09/08/2017 at 11:57 |

|

These guys better go to prison for this.

Nothing

> random001

Nothing

> random001

09/08/2017 at 11:58 |

|

No, you canít freeze if youíre going to refinance, otherwise youíll need to unfreeze it to continue. Also, during the closing process for mortgages, your credit can/will get pulled multiple times.

Nothing

> Straightsix9904

Nothing

> Straightsix9904

09/08/2017 at 11:58 |

|

Nope, donít freeze it until youíre done. For mortgages, your credit gets pulled multiple times during the process.

davesaddiction @ opposite-lock.com

> diplodicus

davesaddiction @ opposite-lock.com

> diplodicus

09/08/2017 at 11:59 |

|

davesaddiction @ opposite-lock.com

> Straightsix9904

davesaddiction @ opposite-lock.com

> Straightsix9904

09/08/2017 at 12:00 |

|

Better to hold off until after everythingís done with the close.

davesaddiction @ opposite-lock.com

> Aaron M - MasoFiST

davesaddiction @ opposite-lock.com

> Aaron M - MasoFiST

09/08/2017 at 12:01 |

|

My wife froze hers too, but the Equifax site crashed right before it gave her the PIN to unfreeze. Freaking circus...

Straightsix9904

> diplodicus

Straightsix9904

> diplodicus

09/08/2017 at 12:04 |

|

And 3 executives sold stock 3 days before it went public. Just 1.8 million though.

Nothing

> davesaddiction @ opposite-lock.com

Nothing

> davesaddiction @ opposite-lock.com

09/08/2017 at 12:07 |

|

I havenít yet, though I probably should. We wonít be applying for any credit anytime soon. For those that donít, use annualcreditreport to pull your credit every 4 months. You can only pull from from one bureau per year, so rotate through Transunion, Experian, Equifax. Itís free. Youíre allowed one free report, per bureau, yearly.

Quite a few credit card issuers, including most major banks, offer a free monthly score report, too.

davesaddiction @ opposite-lock.com

> Nothing

davesaddiction @ opposite-lock.com

> Nothing

09/08/2017 at 12:12 |

|

Unfortunately, if you put on freezes, you have to lift them to check your credit. We just bought a home, so Iím getting a copy of the credit report they ran for our loan. If thatís in order (which it should be) and our freezes our in place, I guess thereís no real reason to check our credit going forward as long as we know weíre paying our bills on time.

Nothing

> davesaddiction @ opposite-lock.com

Nothing

> davesaddiction @ opposite-lock.com

09/08/2017 at 12:20 |

|

Yep, understood. If people donít want to freeze, they should continue to pull their credit as I mentioned in my other post, at a minimum, I guess. I donít pull it any more frequently than that.

With this breach, though, a freeze may be in order.

random001

> Nothing

random001

> Nothing

09/08/2017 at 12:32 |

|

Thanks, bro

davesaddiction @ opposite-lock.com

> Nothing

davesaddiction @ opposite-lock.com

> Nothing

09/08/2017 at 12:40 |

|

Iíve never done it before, but this oneís especially bad.

diplodicus

> davesaddiction @ opposite-lock.com

diplodicus

> davesaddiction @ opposite-lock.com

09/08/2017 at 13:34 |

|

Itís some bullshit for sure. Itís fucked up I have to pay 10$ to each company to freeze it when I never asked to be a part of it in the first place. Worth it instead of someone ruining my credit score but still bullshit.

Tripper

> davesaddiction @ opposite-lock.com

Tripper

> davesaddiction @ opposite-lock.com

09/08/2017 at 13:41 |

|

How did you go about doing that?

Textured Soy Protein

> davesaddiction @ opposite-lock.com

Textured Soy Protein

> davesaddiction @ opposite-lock.com

09/08/2017 at 15:23 |

|

Right, I was more talking about Credit Karma as an alternative to Annual Credit Report.

I looked at the BBB reviews and the overwhelming majority of them was ďmy score on Credit Karma was one thing but then I applied for a car/mortgage/some other loan and the score on that report was lower.Ē

There also appear to be some problems with people not being able to file their taxes. This year Credit Karma added free taxes and I actually did mine thru them with no problem. I just looked back through my emails and both my federal and state returns were accepted the same day as I filed them through Credit Karma. The refunds were issued 8 days later.

I got worried for a sec because I couldnít find the transactions in my checking account but I just reviewed my tax form and they were direct deposited into my savings account. Whoops!

davesaddiction @ opposite-lock.com

> Tripper

davesaddiction @ opposite-lock.com

> Tripper

09/08/2017 at 23:35 |

|

Links in this article: https://www.consumerreports.org/equifax/how-to-lock-down-your-money-after-the-equifax-breach/

davesaddiction @ opposite-lock.com

> diplodicus

davesaddiction @ opposite-lock.com

> diplodicus

09/08/2017 at 23:36 |

|

Yup... $10 to freeze, $10 to thaw, rinse & repeat.

DC3 LS, will be perpetually replacing cars until the end of time

> davesaddiction @ opposite-lock.com

DC3 LS, will be perpetually replacing cars until the end of time

> davesaddiction @ opposite-lock.com

09/13/2017 at 17:31 |

|

Interesting article about the subject.

http://www.makeuseof.com/tag/check-data-stolen-equifax-breach/ †

According to it, my credit information was stolen, so guess Iíll be freezing my stuff too.

Read the whole article before doing what it says. Because according to them when you click ďbegin enrollĒ and enter your info. If your info was stolen itíll ask you to enroll in a program which will void your ability to join a class action lawsuit.

Idk if itís true or not, but Iím certainly doing a credit freeze.